If you’ve watched a single sporting event over the last year, you’ve likely sat through countless commercials for sports betting apps. This explosion of publicity for a previously taboo market may be overwhelming, but it’s an expected result of the hyper-competitive sports betting land grab currently underway in the U.S.

So what happened? Not long ago, daily fantasy sports apps began flirting with major advertising campaigns, notably during the National Football League’s peak season. This exposure allowed brands such as DraftKings and FanDuel to explode in both popularity and revenue.

By leveraging deep linking in their acquisition and engagement campaigns, sports betting apps have pointed the way toward explosive user growth strategies. Below we explore this market boom and provide tips on how to maximize user engagement.

Big bang of an industry

Previously, Nevada was the only state in the U.S. to legally place sports wagers. Yet even that limited geographic market was worth billions of dollars in volume. This combined with hundreds of millions in revenue for sportsbook operators and a tax revenue stream that would move the needle in most states.

In 2018, the U.S. Supreme Court overturned the Professional and Amateur Sports Protection Act (PASPA, 1992). Doing this lifted the ban on states establishing their own sports wagering markets. Now a few years later, the sports gambling market has already reached $50B. And it’s growing fast.

While each state has its own regulations on sportsbook operators, 14 states and Washington D.C. have launched mobile gaming apps that allow sports wagering for anyone over 21 with a device confirmed to be in that state at the time of the wager.

Mobile devices turn out to be the perfect platform to accelerate this industry. With such a massive and previously underserved market, the competition to grab market share has been ferocious. User lifetime value is already enormous, justifying the high acquisition costs. This combination of factors has led to some of the highest cash incentives for consumers ever seen from a digital platform.

Approaching 10M users in the U.S. already, the market could reach $100B in volume in 2022. And carving that market up are strong brands led by players like DraftKings, FanDuel, BetMGM, and Caesar’s. All are trying to cement themselves as the top betting destination for new users.

What kind of business is this anyway?

Consider these platforms from different industry perspectives. They’re much more than financial markets. They’re also entertainment and gaming platforms with an obvious emphasis on the diverse world of global sports. In practice, they’re conversion-focused eCommerce apps that require users to “shop and transact.” This creates the potential for these apps to become social media platforms. And all the while, they layer on loyalty and rewards programs to underlie user retention just like any other usage-based offering.

A single app experience requires these platforms to meet and optimize certain business objectives. These objectives are sometimes just a singular focus in other industries:

- Finance: Ensure security of monetary transactions as a trusted platform.

- Gaming & Entertainment: Maximize engagement and fun.

- Sports: Personalization and community is key.

- eCommerce: An intuitive and efficient shopping experience.

- Social: Enable seamless peer-to-peer and brand influencer social engagement.

- Loyalty: Maximize user retention and lifetime value through incentives.

The competition for market share is already fierce. We’re seeing market leaders differentiate themselves by providing better user experiences and employing strategies that address all the requirements demanded from a multi-faceted platform. But we’re also seeing huge missed opportunities due to basic product features that other industry verticals have already mastered.

What are some of the best channels for acquisition?

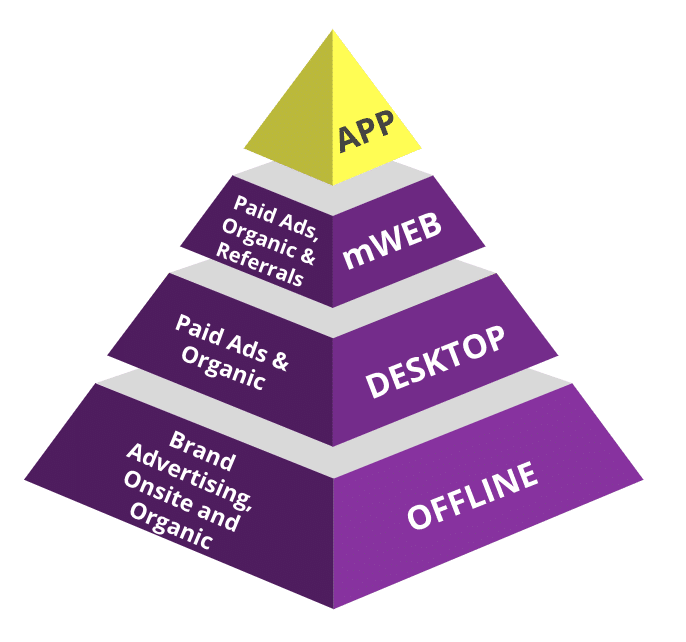

Sports betting is perfect for mobile devices and apps. But before any platform can scale the business through engagement, it must first acquire users and drive app adoption.

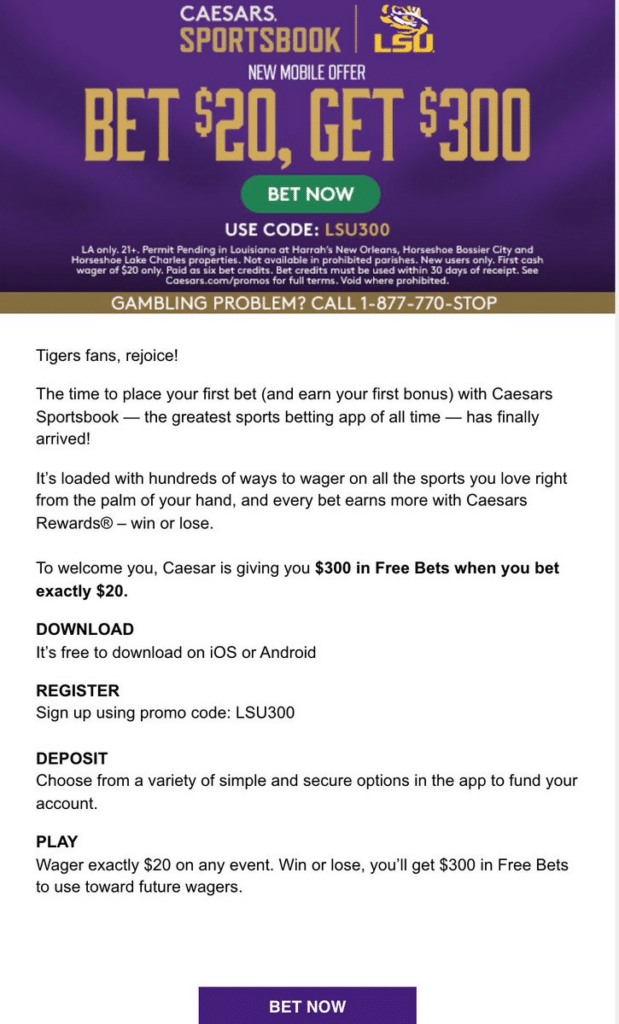

Ads are ubiquitous at this point, to the point of saturation. But ads also work. When the lifetime value of a user is high, brands are willing to bid aggressively for airtime both on TV and on all digital platforms to acquire users. Once users arrive, enormous incentives are offered to ensure users complete the sign-up process.

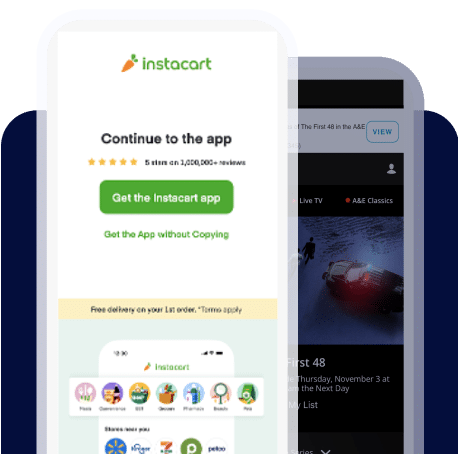

Getting users to download and successfully onboard to an app should be every brand’s early goal. App users will see more, do more, convert more, and spend more. And they’ll do it all faster with fewer glitches.

How your app can maximize user acquisition

Deep links

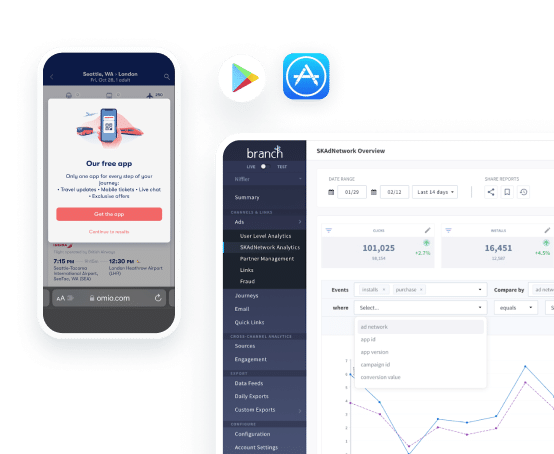

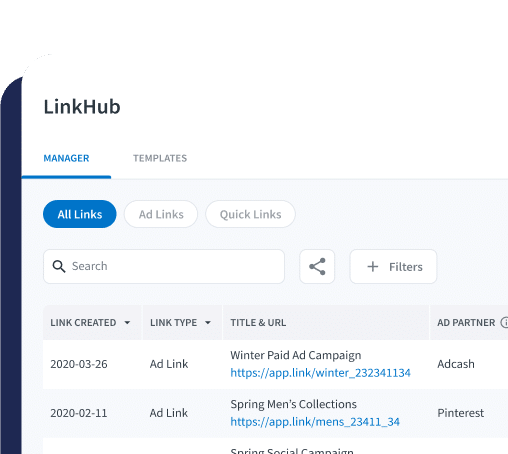

‘Deep Links’ or ‘Deferred Deep Links’ are links that bring a non-app user to the app store for downloading and then immediately to the desired in-app content. Using deferred deep links, brands can create a personalized activation experience through both the app install process and when the app is first launched. With the deferred deep linking experience, you can ensure the user will not lose their sign up bonus activation and will get to the right place to start betting.

QR codes

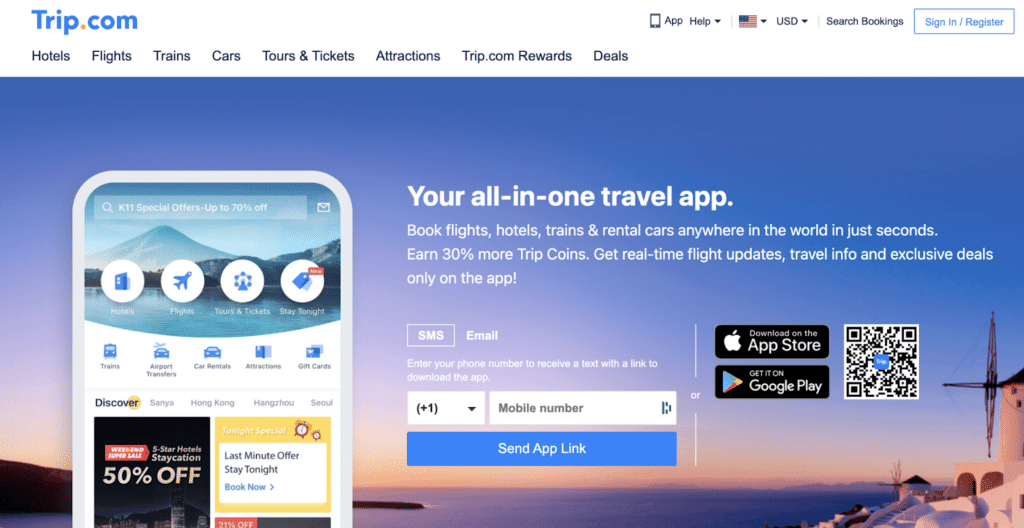

Website acquisition is a no-brainer. And yet, sites completely fail to be proactive with app download prompts and instead simply put logo links to the app store on landing pages. There is a better way, and it costs very little — QR codes.

Adding QR codes to the landing page creates an easy pathway for users to activate a deferred deep link. It also allows them to onboard with a bonus confirmation. It can even add more parameters like geography, to customize the content users are shown once logged in.

And “thanks to” a pandemic — and even a recent Super Bowl ad featuring a QR Code — smartphone users now know how to activate a QR code in everyday life.

Journeys (smart banners)

Migrating users from mobile web registration into the app is even easier. Branch offers Journeys, a smart banners product for mobile websites. Journeys can be easily targeted, personalized, and optimized with branded creatives. And, depending on the user journey, smart banner strategies can be tailored to meet not just sports betting app needs, but any app needs.

Best channels to promote user engagement

Onboarding and app adoption are only half the battle. For sports betting apps to retain users, they must engage them effectively. Fortunately, there are multiple pathways to encourage daily engagement.

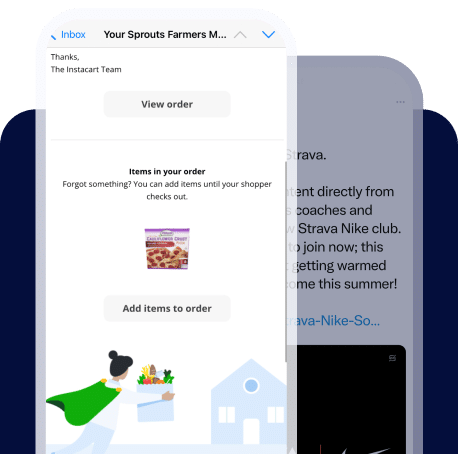

Email enables tap-to-app engagement, making it a valuable channel. With robust deep linking, email is an extension of the brand itself. It pulls users into specific content and activates promotions with a single tap. Email even drives users to adopt features that will enhance their app experience. So far, only a few sports betting apps are deep linking emails to their U.S. customers. Even then, they’re likely not capturing down-funnel event attribution. There are still a lot of opportunities for platforms to stand out with superior email engagement.

Social

Unlike email, deep linking social media to the app isn’t the issue. The issue is that social media isn’t deep linked at all! The leading sports betting platforms in the U.S. have a massive social following with highly topical content. But not a single one is linking into their apps. That means those platforms are unable to leverage a highly engaged channel of loyal customers with obvious opportunities to transact.

Referrals

Referrals or shared links are relatively common and see the best adoption in apps with an engaging entertainment focus. Enabling peer-to-peer engagement through an app referral program is all upside. It can be leveraged in one-off sharing pathways via SMS or other messaging channels, or via one-to-many social media posts from loyal users or paid influencers.

DraftKings reported that users leveraging social sharing app features were significantly more engaged and had a higher transaction volume. Given the inspiring results seen by DraftKings, the race should be on to close this opportunity gap.

As noted above, betting apps transcend multiple industry verticals. They can learn from the playbooks already utilized by brands in finance, eCommerce, entertainment, and others. But the holistic strategy of app engagement across all channels is one that could be embraced by all brands. Once the battle for acquisition starts, the long-game of user engagement and retention will determine long-term success for any brand with an app.

Branch is ready to tackle this with you!

Sports betting apps are finally getting their big moment, and the huge market opportunity is drawing innovation. We have also yet to see any major players leave the ring or any significant consolidation among betting platforms. The long-term playing field has yet to be decided. But early market shares suggest that usability features will play an important role in deciding the true winners.

Eventually, we should expect some failures and exits. Throwing money at user acquisition was a previously unheard of strategy, and it can’t be sustainable. Yet some platforms are pouring new users into a user experience rife with churn.

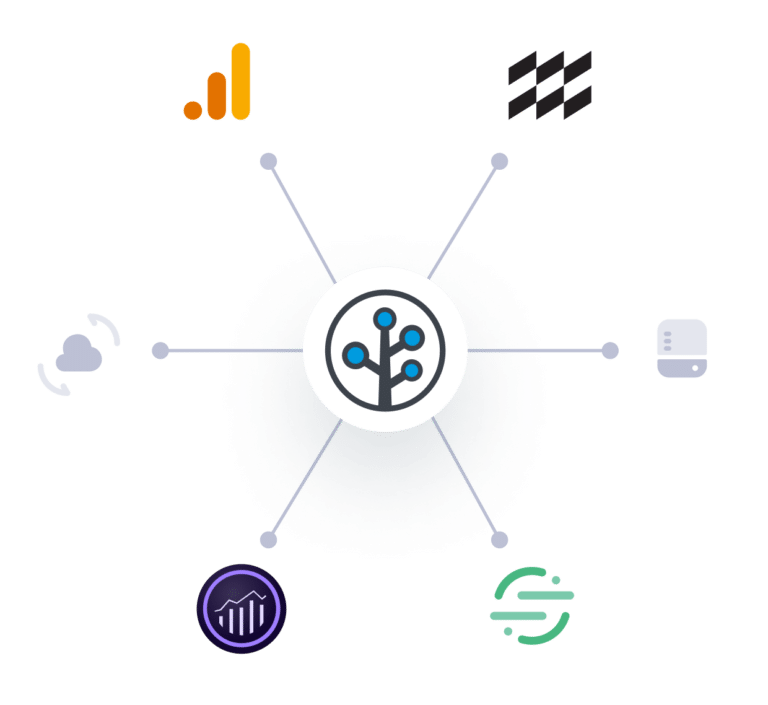

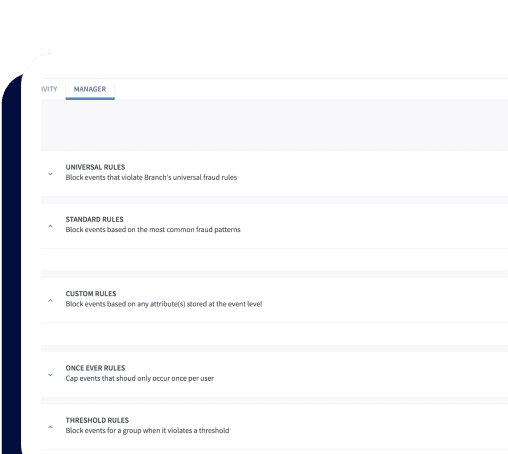

Fortunately, the tools and playbooks needed to win this race have already been mastered. Branch’s mobile linking platform (MLP) has helped apps in all verticals engage seamlessly with customers to drive higher retention and lifetime value. And the tools necessary to accelerate app adoption have already been deployed with great success by Branch customers around the world.

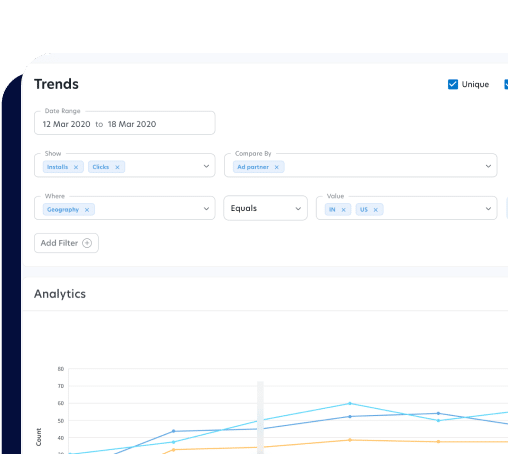

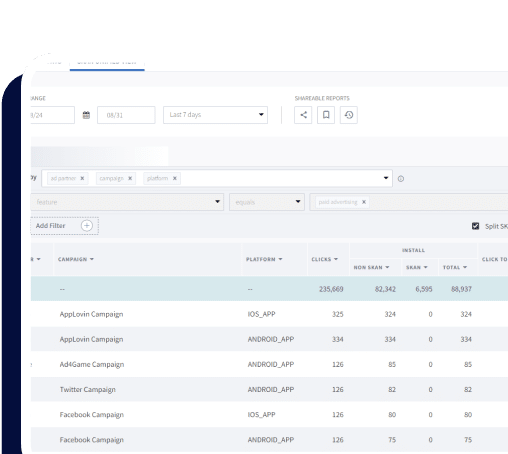

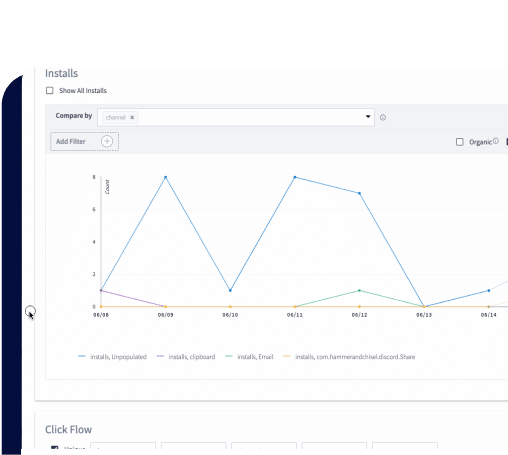

Furthermore, comprehensive and reliable data from Branch’s mobile measurement partner (MMP) provides the attribution and down-funnel analysis that any data-driven marketer should demand from their platform in order to make optimal decisions.

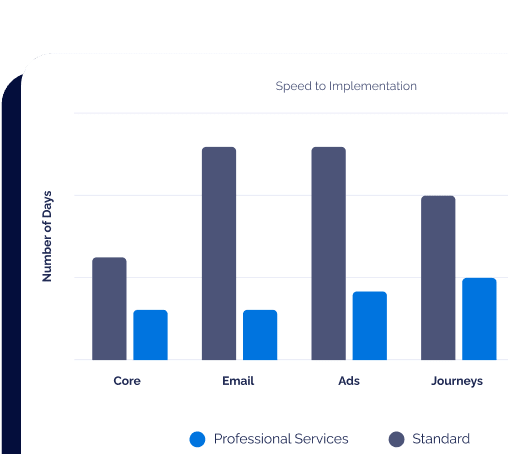

In a competitive land grab, speed-to-value is critical. That’s why Branch makes an ideal strategic partner for those platforms intent on winning in this lucrative, long-term consumer market.

Branch provides the industry’s leading mobile linking and measurement platforms, offering solutions that unify user experience and attribution across devices and channels. Branch has been selected by over 100,000 apps since 2014 including Adobe, BuzzFeed, Yelp, and many more, improving experiences for more than 3 billion monthly users across the globe. Learn more about Branch or contact sales today.