Among the many strange signals reaching Americans during a period of uncertainty, upheaval, and social distancing are messages of reassurance from our services providers. America is, after all, a services-based economy. Inboxes are now flooded with businesses reaching out to customers to explain how they will be handling this period of volatility.

In some cases, these messages only compound our fears, suddenly calling into question the stability of a certain company. Why is this website I bought from five years ago now assuring me everything is OK? Should I be worried? When it’s telecoms, utilities, and banks messaging “customers,” you realize how much of a consumer-based society we really are. What might be considered critical infrastructure, is also dependent on consumer choice.

Regardless of the anxiety they fuel, these messages are still the responsible protocol. And hidden within this outreach are hints of a brighter future, one where consumers more fully adopt technology solutions into their everyday lives, and start living up to the standards of the 21st century. The world is going to change significantly, even after our long-term recovery from the pandemic of 2020.

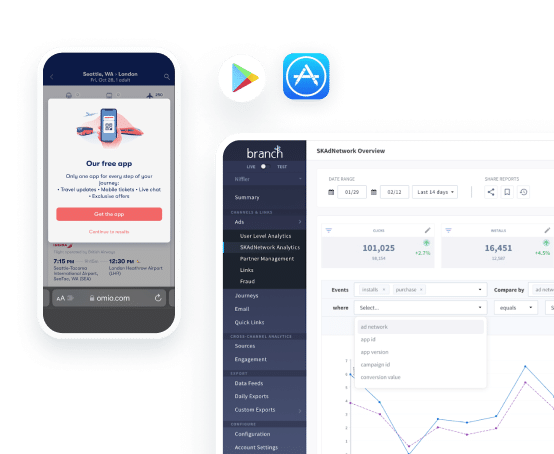

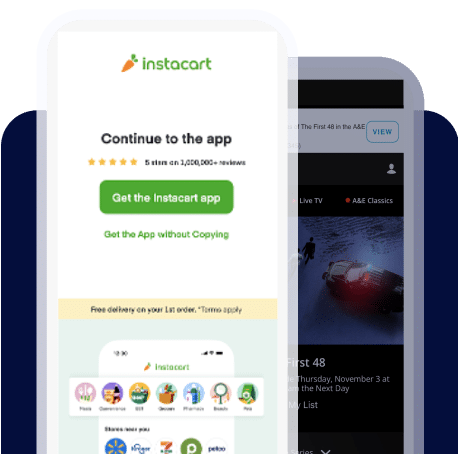

By now, you’ve likely received a message from your retail bank. If you didn’t read it thoroughly, you might have missed a specific call to action to download the bank’s mobile app. The messaging always points out that your mobile app works 24/7, wherever you are, and they possibly threw in an increase to your mobile deposit limit. You can do many of the things you might do at a branch location, or from your desktop computer. The power to check a balance or payment status, pay bills, and even deposit checks using your phone camera, have all been placed in your hands. Any time, anywhere. But are people using this power?

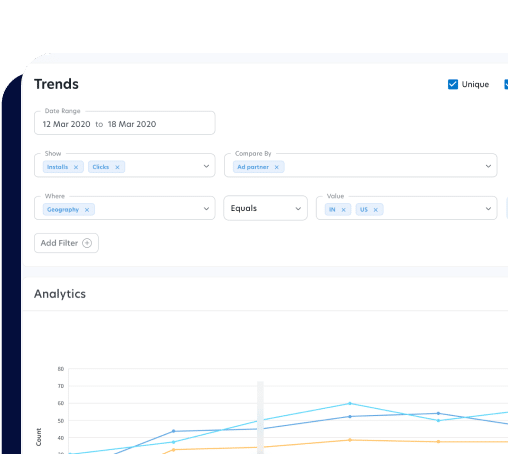

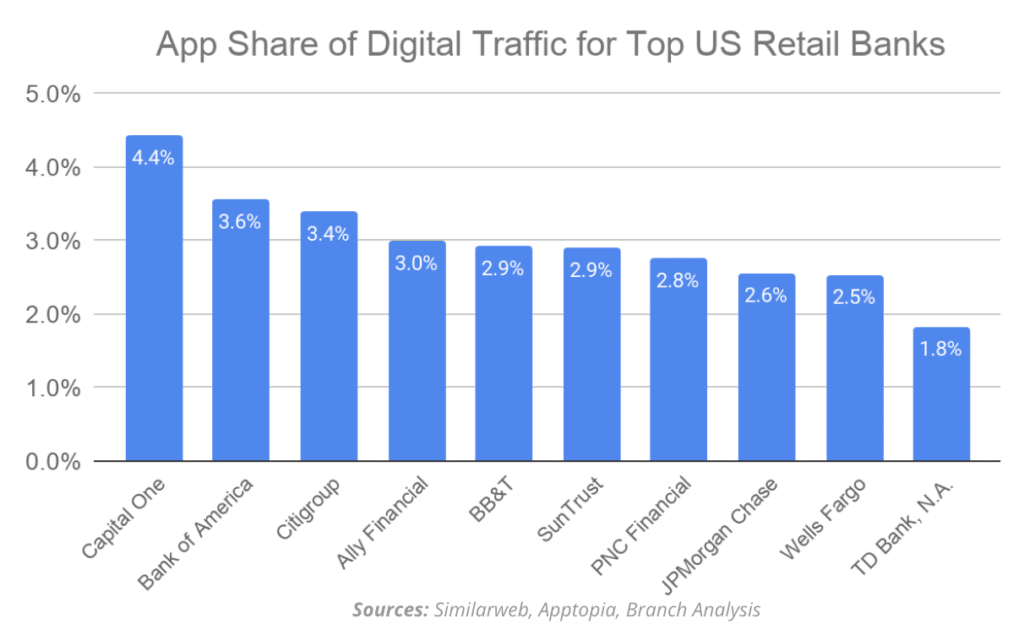

Most leading retail banks pre-date the proliferation of smartphones, so consumer adoption has been slow. A glance at the top 10 commercial banks in the US reveals hundreds of millions of online sessions, but in-app monthly users are just 3% percent of total web MAUs. That means while most Americans are doing “online” banking, very few are using their bank’s mobile app.

Within that 3% of app traffic is another surprising finding: high engagement. The same 10 banks saw on average 40% of app users interacting with the app on a daily basis. This app DAU/MAU rate demonstrates how fundamentally important banks really are to the average consumer in the U.S.

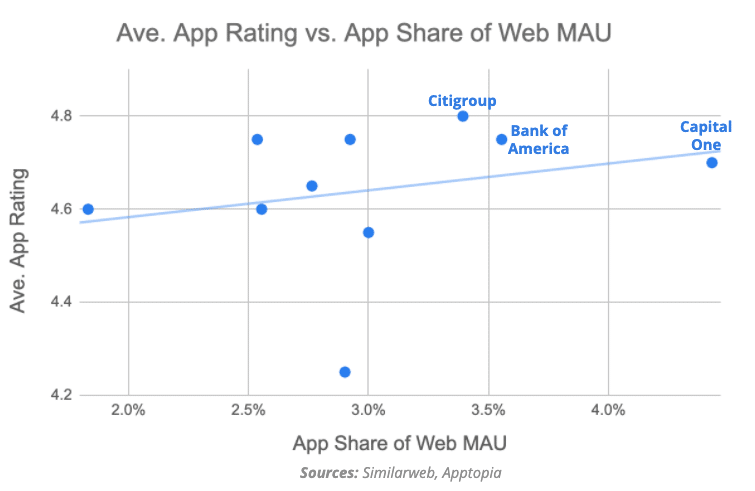

A closer look at the apps offered by these industry leaders reveals that not all banking apps are created equal. Banks generally score highly in app store ratings by their users, but even slightly lower scores correlate with lower app adoption. High scoring apps average higher app adoption, higher relative install rates, and higher daily engagement compared to lower scoring apps. And how consumers interact with these apps could be a leading indicator for where they will choose to bank in the future.

More good news for banks is that once an app is installed, it’s getting used. There’s a tight correlation between trailing installs and current app usage. Once installed, users are choosing the app to engage with their bank over desktop and mobile web. And the better the app score, the better the adoption of the app.

The winner of the group is Capital One, with an above-average rating, highest app share of digital traffic, and the most installs last year relative to total traffic. App adoption among banks is set to explode, and the winners in the race to serve a great mobile experience to customers could emerge in a different place in 2021 and beyond.

Clearly, many things will change when life bounces back to normality. As someone who has never enjoyed shaking hands as a mandatory gesture, I’m already thinking about a world in which I can give the Spock salute, or elbow bump instead.

And there’s a lot more to look forward to in a world that has experienced such a significant disruption, most stemming from technological solutions already available. More investments into home fitness equipment. An acceleration and increase in adoption of remote working jobs. An evolution of at-home entertainment and education content. No weird gawks if someone wears a mask when they have a cold. And we will finally see comprehensive adoption of entirely mobile banking and electronic payments.

Fundamentally, your bank is pretty important, and you’ll still interact with it routinely. But now many consumers who went to branches and ATMs out of habit will suddenly break that behavior. Even more will adopt a cashless lifestyle, leveraging a wide variety of modern FinTech solutions. If we stop shaking hands, we can easily stop touching cash machines and money.